18

January, 2024

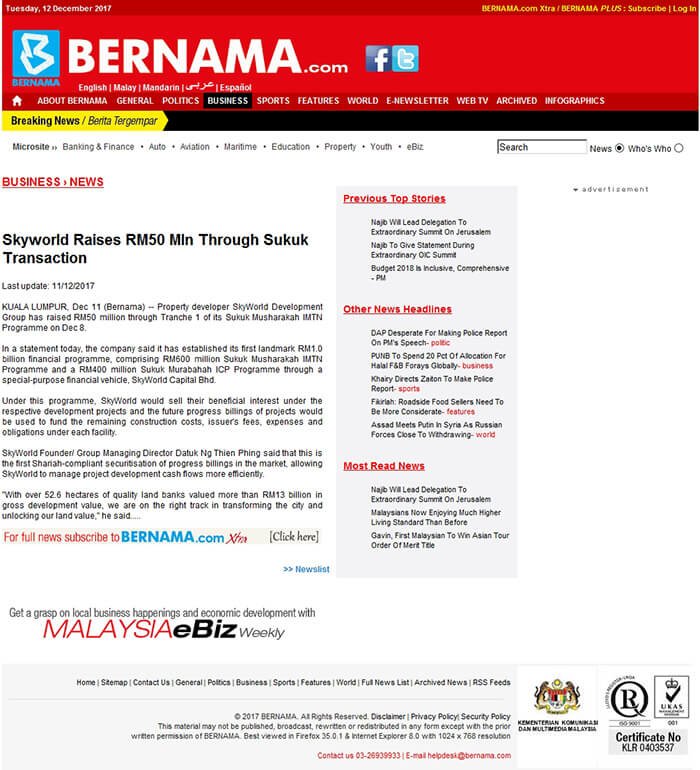

SkyWorld First Landmark Sukuk Transaction

On 8 December 2017, SkyWorld Development Group successfully raised RM50 million through Tranche 1 of its Sukuk Musharakah IMTN Programme. This Tranche 1 is part of SkyWorld RM1.0 billion financial program comprising RM600 million Sukuk Musharakah IMTN Programme and a RM400 million Sukuk Murabahah ICP Programme through a special-purpose financial vehicle, SkyWorld Capital Berhad. Under this program, SkyWorld and its group of companies will sell their beneficial interest under the respective development projects.

Datuk Ng Thien Phing, Founder and Group Managing Director of SkyWorld opined, “This is the first structured transaction in Malaysia involving unbilled sales and the first to involve affordable housing. Globally, this is also the first Shariah-compliant securitization of progress billings in the market, allowing SkyWorld to more efficiently manage project development cash flows. Despite being a relatively young and emerging developer, SkyWorld is always on the lookout for innovative funding. We are thankful for the support of all parties concerned and these events signalled a positive start for SkyWorld Development Group. With over 130 acres of quality land banks totalling more than RM13 billion in gross development value, we are on the right track of transforming the city and unlocking our land value.”

The first project to be securitised under this financing program is the SkyAwani Residence project in Sentul and is rated AA3/Stable by RAM Rating Services Berhad (‘RAM Ratings’). The RM50 million Tranche 1 IMTN is secured against 1,260 SPAs for its SkyAwani Residence project in Sentul, Kuala Lumpur whilst the unrated Tranche 1 ICP of up to RM41 million, which is meant to underwrite construction of SkyAwani development and liquidity risk of Tranche 1 is guaranteed by Danajamin Nasional Berhad and fully underwritten by Alliance Investment Bank Berhad. RAM Ratings had applied a rigorous and extensive credit rating process to the SkyAwani project to ensure institutional investors’ credit interest is protected at all times. The credit rating accorded to SkyAwani is a reflection of SkyWorld’s efficient management execution, strong performance capability, a high percentage of lock-in sales backed by end financing and historical track record of completing projects on time and well within budget with no incidence of any delays.

NEWS CLIPPING

RELATED ARTICLES

Thursday, 14 March, 2024

List of 10 Reputable Vietnamese Real Estate Companies 2024

Wednesday, 28 February, 2024

Top 10 Reputable Real Estate Companies In Malaysia

Wednesday, 27 March, 2024