18

January, 2024

Main Market-Bound SkyWorld Launches IPO Prospectus

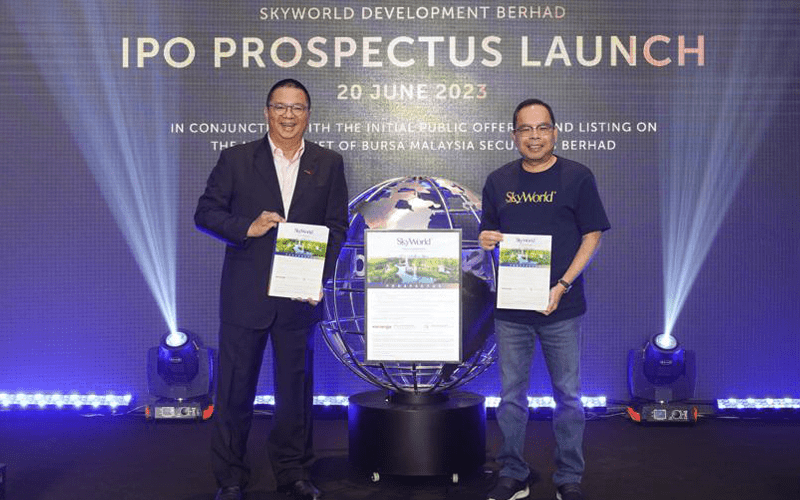

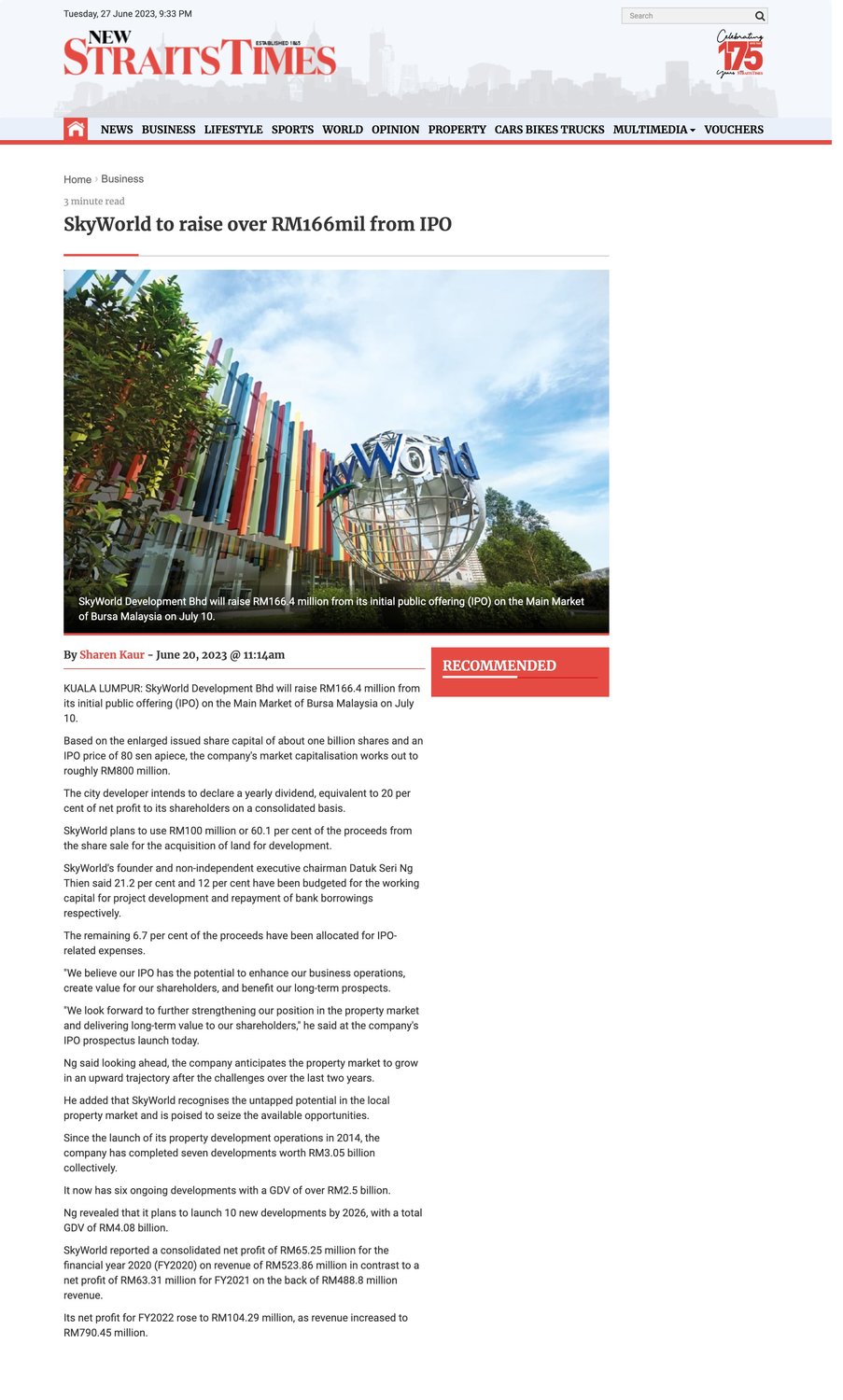

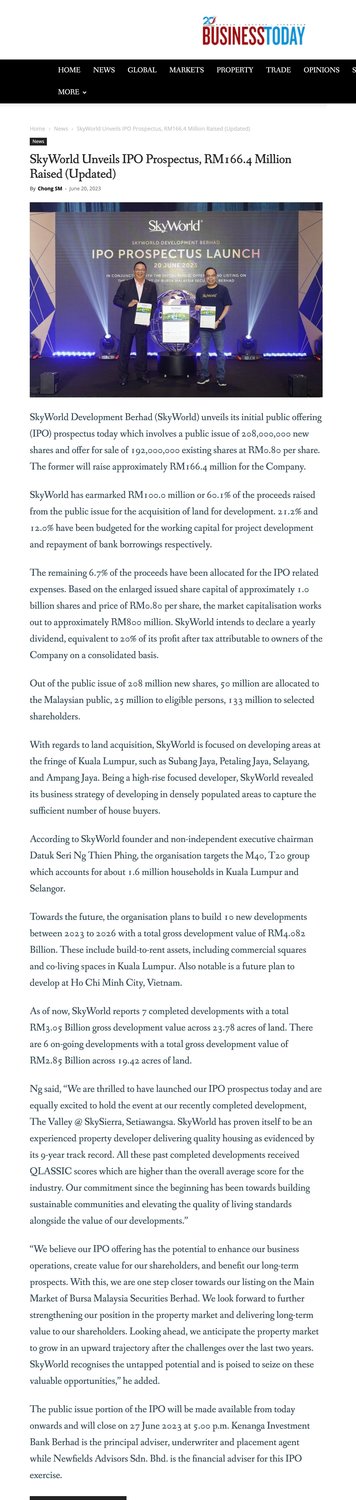

SkyWorld Development Berhad (“SkyWorld” or the “Company”) an urban property developer principally involved in investment holding, provision of management services to its subsidiaries and property development, unveiled its initial public offering (“IPO”) prospectus today. This is in conjunction with its proposed listing on the Main Market of Bursa Malaysia Securities Berhad, which is set for 10 July 2023. The launch was held at The Valley Residences, SkyWorld’s newly completed residential development located at Setiawangsa, Kuala Lumpur and is the 8th completed project by the Company.

The IPO exercise involves a public issue of 208,000,000 new shares and offer for sale of 192,000,000 existing shares at RM0.80 per share. The former will raise approximately RM166.4 million for the Company. SkyWorld has earmarked RM100.0 million or 60.1% of the proceeds raised from the public issue for the acquisition of land for development. 21.2% and 12.0% have been budgeted for the working capital for project development and repayment of bank borrowings respectively. The remaining 6.7% of the proceeds have been allocated for the IPO related expenses.

Based on the enlarged issued share capital of approximately 1.0 billion shares and price of RM0.80 per share, the market capitalisation works out to approximately RM800 million. SkyWorld intends to declare a yearly dividend, equivalent to 20% of its profit after tax attributable to owners of the Company on a consolidated basis.

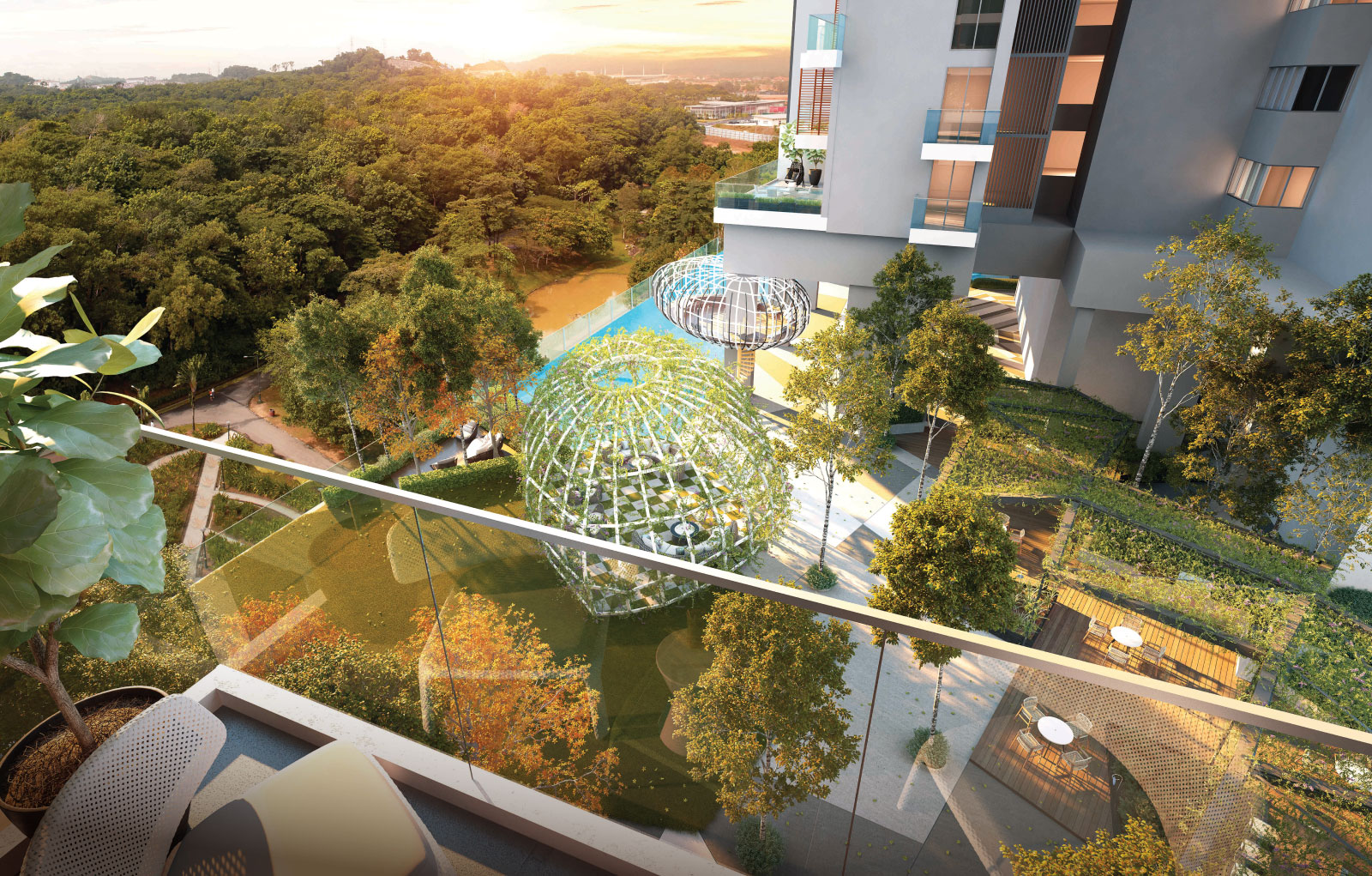

SkyWorld founder and non-independent executive chairman Datuk Seri Ng Thien Phing said, “We are thrilled to have launched our IPO prospectus today and are equally excited to hold the event at our recently completed development, The Valley @ SkySierra, Setiawangsa. SkyWorld has proven itself to be an experienced property developer delivering quality housing as evidenced by its 9-year track record. All these past completed developments received QLASSIC scores which are higher than the overall average score for the industry. Our commitment since the beginning has been towards building sustainable communities and elevating the quality of living standards alongside the value of our developments.”

“We believe our IPO offering has the potential to enhance our business operations, create value for our shareholders, and benefit our long-term prospects. With this, we are one step closer towards our listing on the Main Market of Bursa Malaysia Securities Berhad. We look forward to further strengthening our position in the property market and delivering long-term value to our shareholders. Looking ahead, we anticipate the property market to grow in an upward trajectory after the challenges over the last two years. SkyWorld recognises the untapped potential and is poised to seize on these valuable opportunities,” he added.

Kenanga Investment Bank Berhad executive director and head of group investment banking and Islamic banking Datuk Roslan Hj Tik said, “The IPO exercise comes at an opportune time for SkyWorld, considering the growth opportunities for housing projects in Kuala Lumpur, as urbanisation continues to pick up pace coinciding with the overall economic development of Malaysia . I would like to extend our appreciation to the board and management of SkyWorld for trusting us, Kenanga Investment Bank Berhad, with the role of principal adviser, underwriter, and placement agent for this exercise.”

The public issue portion of the IPO will be made available from today onwards and will close on 27 June 2023 at 5.00 p.m. Kenanga Investment Bank Berhad is the principal adviser, underwriter and placement agent while Newfields Advisors Sdn. Bhd. is the financial adviser for this IPO exercise.

NEWS CLIPPING

RELATED ARTICLES

Thursday, 14 March, 2024

List of 10 Reputable Vietnamese Real Estate Companies 2024

Wednesday, 27 March, 2024

6 Best Jogging Places in Kuala Lumpur for You

Wednesday, 28 February, 2024